Crypto exchange Bybit is pushing back against serious allegations that surfaced on social media, denying claims that it demands a $1.4 million fee to list tokens on its platform. The accusations came from X user “silverfang88,” who has a following of over 100,000. The user also claimed that Bybit used influencers to suppress criticism from students involved in its Campus Ambassador program.

Bybit CEO Responds: “Show the Evidence”

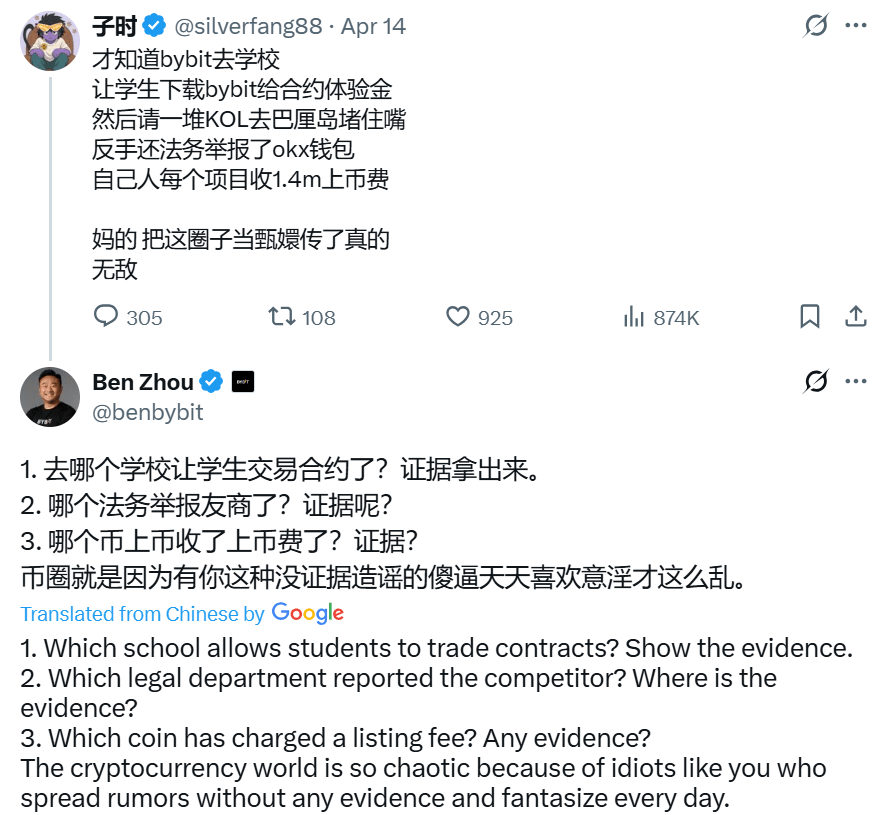

Bybit CEO Ben Zhou quickly responded to the accusations, urging the user to present any proof to support the claims.

“The crypto space is already chaotic enough with baseless rumors,” Zhou wrote on X, calling for more responsibility in the way information is shared online.

What Bybit Actually Requires for Listings

In response to the growing speculation, the Dubai based exchange issued an official statement clarifying its token listing process. The exchange emphasized that it does not charge a $1.4 million listing fee. Instead, projects must meet three core requirements: a promotion budget, a security deposit, and a thorough evaluation process.

The company explained that it asks for a $200,000 to $300,000 security deposit-not a fee-to ensure that promotional obligations are met. This amount is held in stablecoins, and penalties may apply if targets aren’t reached. Bybit also stated that promotional funds are used for user engagement campaigns, though legal limitations prevent the exchange from directly holding project tokens.

Also Read: Top White Label Crypto Exchange Providers in 2025

Rigorous Evaluation Before Any Listing

Bybit outlined a multi-step evaluation process for projects applying to be listed. This includes form submissions, internal votes, in-depth research, and a final listing review meeting. The vetting process covers fundamentals such as:

- On-chain activity and data

- Token use cases and valuation

- Project authenticity and team credentials

- Address validation and user distribution

These checks, according to the exchange, are designed to protect users and uphold trust in the listing process.

Campus Ambassador Program Under Fire

Beyond listing fees, the X user also alleged that Bybit handed out trial contracts to students through its 2024 Campus Ambassador initiative and used key opinion leaders (KOLs) to silence complaints.

While Zhou again asked for evidence to back these claims, Bybit has yet to issue a direct response regarding the ambassador program allegations. At the time of writing, the exchange has not confirmed or denied any connection to the alleged suppression of student voices.

Latest: New York to Accept Crypto for State Transactions

Final Word: Transparency vs. Speculation

Bybit’s swift response highlights the tension between transparency and rumor in the crypto world. As platforms like Bybit expand globally, the need for clear communication and verified claims becomes more crucial than ever.

For now, the exchange is standing its ground-firmly denying that it charges exorbitant listing fees or manipulates student participants in its programs. Whether further evidence surfaces remains to be seen.